Mega backdoor roth pro rata — five words that can wreck your tax strategy if you don’t understand them.

A few years ago, I was 49, working full-time at a big tech company, and trying to shovel as much as I could into retirement accounts. I’d just discovered the mega backdoor Roth strategy, but then I hit a wall: the pro rata rule. And it nearly cost me thousands.

You might be doing everything “by the book” — contributing after-tax dollars to your 401(k), converting to a Roth IRA — and still get sideswiped by a tax bill. That’s why this article matters.

We’re going to walk through:

- What the pro rata rule really means in the context of the mega backdoor Roth

- The key ways to legally sidestep it

- Real-world examples (not just IRS jargon)

- Why most guides skip the hard parts

And if you’re just getting started, check out our mega backdoor Roth full guide here — it sets the groundwork for everything below.

Let’s start with the truth about the mega backdoor Roth pro rata rule — and how to avoid learning it the hard way.

Key Takeaways

The mega backdoor roth pro rata rule taxes your Roth conversion if you have pre-tax IRA balances. Avoid it by using in-plan Roth conversions or rolling IRAs into your 401(k).

In this article, we’ll discuss:

What the Mega Backdoor Roth Pro Rata Rule Actually Means

The Hidden Catch Behind the Strategy

Back when I first tried the mega backdoor Roth, it sounded too good to be true — and in some ways, it almost was.

Here’s the gist of how it works:

You contribute after-tax dollars to your 401(k), then convert them to a Roth IRA or Roth 401(k) before they gain much in earnings. Since the contribution was after-tax, you shouldn’t owe anything at conversion.

But here’s the trap:

If you have any pre-tax money sitting in any traditional IRA (like a rollover IRA from a past job), then the IRS looks at all your IRAs as one big soup. That’s the pro rata rule — and it applies when you convert funds out of that soup.

So even if you only convert your after-tax 401(k) dollars, the IRS may force you to pay taxes on a proportional mix of pre-tax and after-tax funds. That could mean thousands in surprise taxes.

Let’s Break It Down with Simple Math

Let’s say:

- You have $150,000 in a rollover IRA (all pre-tax)

- You contribute $10,000 after-tax to your 401(k)

- You do a mega backdoor Roth conversion of that $10,000 to your Roth IRA

You think: “No taxes! It’s after-tax money.”

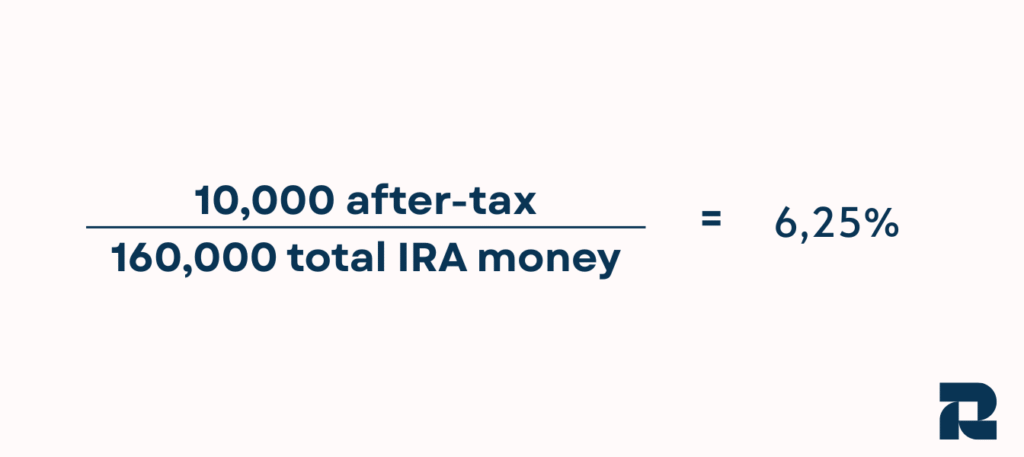

But under the pro rata rule, your tax-free portion is just:

That means only $625 of the $10,000 is tax-free. You pay income tax on the other $9,375.

That’s how the mega backdoor roth pro rata rule bites — and you don’t even see it coming until the 1099-R shows up.

What Makes This Different from the “Backdoor Roth”?

The regular backdoor Roth IRA also hits this same rule — but with a difference: it usually involves smaller dollar amounts and direct IRA-to-Roth conversions.

The mega backdoor Roth, on the other hand, can involve up to $69,000 in 2024 when including employer matches. That’s a much bigger tax hit if you get it wrong.

And if you don’t clear out your pre-tax IRAs before converting? You’re stuck. Unless…

Legal Workarounds That Actually Work

Here’s what I did — and what most advisors don’t spell out clearly.

1. Roll Pre-Tax IRA into Your 401(k)

Most 401(k) plans will accept roll-ins. This removes the pre-tax funds from the “IRA soup” and makes your after-tax conversion clean. I moved $120k this way before touching my Roth.

See: Solo 401k Mega Backdoor Roth for one powerful way to do this if you’re self-employed.

2. Convert to Roth Within the 401(k) Plan

If your plan allows in-plan Roth conversions, the pro rata rule doesn’t apply — because it’s a 401(k), not an IRA. That’s the game-changer.

401k In-Plan Roth Conversion Pro Rata Rule

Most people hear about the mega backdoor roth pro rata rule and assume it applies to everything. But here’s the nuance: when you do a 401k in-plan Roth conversion, the pro rata rule does not apply the same way it does with IRAs.

This is the crucial difference. The mega backdoor roth pro rata rule is triggered primarily when you move funds from a 401(k) to a Roth IRA, not when you stay inside the 401(k). If your plan allows you to convert after-tax contributions to a Roth 401(k) — before rolling anything out — you can completely avoid the mega backdoor roth pro rata issue.

That’s because the IRS aggregation rules that drive the pro rata rule only apply across IRAs — not within 401(k)s. There is no “IRA soup” to stir when you stay inside your 401(k). No calculation that mixes your pre-tax and after-tax balances. That means a clean Roth conversion, even if you have a large traditional IRA sitting untouched.

In my case, I had an old rollover IRA from a previous employer. If I had moved my after-tax 401(k) dollars to a Roth IRA, the mega backdoor roth pro rata rule would have taxed most of the conversion. Instead, I used the in-plan conversion feature. No IRS soup, no tax bill.

If you’re still wondering whether this matters to you, it does — especially if you’re doing six-figure after-tax contributions. That’s why we break this down in full at MBR strategy page, because this is where most people go wrong.

The 401k in-plan Roth conversion pro rata rule is not a rule — it’s an escape hatch. It’s the legal way to implement a mega backdoor roth without being tripped up by the pro rata rule.

Mega Backdoor Roth Tax Implications

Why the Mega Backdoor Roth Pro Rata Rule Triggers Taxes

The mega backdoor roth pro rata rule is the IRS mechanism that mixes all your IRA accounts into one calculation. It doesn’t care which dollars you actually touched. If you convert any part of your after-tax contributions from your 401(k) to a Roth IRA and you have pre-tax money sitting in any traditional IRA, the IRS will apply a pro rata ratio.

That means even if your conversion was technically made up of after-tax contributions, a big chunk will be taxed — simply because the IRS assumes you’re converting a blend of pre- and post-tax dollars.

Real-Life Example of the Tax Trap

Let’s say:

- You have $15,000 after-tax in your 401(k)

- You have $85,000 in an old traditional IRA

- You convert the $15,000 to a Roth IRA

Under the mega backdoor roth pro rata rule, only 15% of that is treated as after-tax. So you’d owe income tax on $12,750 — a surprise for many who thought it was tax-free.

How I Avoided the Mega Backdoor Roth Pro Rata Tax

I had that exact scenario. The fix? I rolled my traditional IRA into my current employer’s 401(k) plan, which accepted roll-ins. That removed the pre-tax IRA balance from the equation, and suddenly the mega backdoor roth pro rata ratio was 100% post-tax — no surprise taxes.

This move is legal, clean, and often overlooked. But it’s one of the most effective strategies to avoid the IRS’s pro rata calculation during a mega backdoor roth conversion.

The Invisible Tax Penalty of Getting It Wrong

Many people don’t realize the IRS isn’t just watching one account — it’s aggregating your entire IRA universe when applying the mega backdoor roth pro rata rule. The penalty is subtle: you think you’re doing a tax-free move, but then you end up paying ordinary income tax on most of the conversion amount.

This is why even financially savvy high earners get burned. They follow the right steps, but the order of operations matters more than most guides admit.

Where to Learn More

For a complete breakdown of this strategy and its tax implications, head over to our detailed guide on mega backdoor roth tax implications. We go step-by-step on how to avoid the mega backdoor roth pro rata problem using in-plan conversions, rollovers, and timing strategies.

Pro Rata Rule Backdoor Roth

What Is the Pro Rata Rule in a Backdoor Roth?

The pro rata rule backdoor Roth issue is often confused with the mega backdoor roth pro rata scenario, but both work off the same IRS principle: when you do a Roth conversion, you must treat all your traditional IRA money as one single account.

This means you can’t just isolate your after-tax contributions and convert them tax-free. The IRS forces you to calculate the percentage of after-tax vs. pre-tax money across all your IRAs, then taxes the appropriate percentage of your conversion.

If you’re doing a standard backdoor Roth, which typically involves:

- Making a non-deductible traditional IRA contribution

- Converting it to a Roth IRA

Then you’re exposed to the same pro rata rule, especially if you have other pre-tax IRA balances sitting around from rollovers, SEP IRAs, or old contributions.

Why the Mega Backdoor Roth Pro Rata Rule Is Even Riskier

Now, let’s tie this back to the mega backdoor roth pro rata issue. The stakes are much higher with a mega strategy. A traditional backdoor Roth might involve $6,500. But a mega backdoor Roth can include $30,000 to $69,000 in after-tax contributions.

That means if the pro rata rule applies during your mega backdoor Roth, you’re not just taxed on a few thousand — you could owe income taxes on tens of thousands in conversions. The IRS doesn’t distinguish between the source; it just runs the pro rata calculation across all your IRAs.

Avoiding the Pro Rata Rule in Both Backdoor Roths

Whether you’re doing a small backdoor or a mega backdoor Roth, the key to avoiding the pro rata rule is the same:

- Clear out all traditional IRA balances

- Roll old IRAs into your 401(k) if your plan allows

- Use in-plan Roth conversions when possible to avoid touching IRAs at all

These steps are essential if you want to sidestep the mega backdoor roth pro rata penalty and make your Roth conversion tax-free.

For more detail on IRA aggregation and how to avoid this, refer to our guide on mega backdoor roth and backdoor IRA integration.

Roth Conversion Pro Rata Rule IRS

How the IRS Applies the Pro Rata Rule to Roth Conversions

The roth conversion pro rata rule IRS enforcement is straightforward — and unforgiving. According to IRS Publication 590-B, when you convert any portion of a traditional IRA to a Roth IRA, the IRS requires you to treat all of your IRA accounts as one combined pot.

This means if you’re converting $20,000 in after-tax dollars from one account, but you also have $80,000 in pre-tax dollars elsewhere, the IRS calculates the tax liability as if you converted a proportional share of each. That’s the heart of the roth conversion pro rata rule IRS application.

And this directly impacts anyone attempting a mega backdoor roth who doesn’t understand how the mega backdoor roth pro rata rule triggers under the IRS’s aggregation rules.

IRS Example of Pro Rata Rule in Action

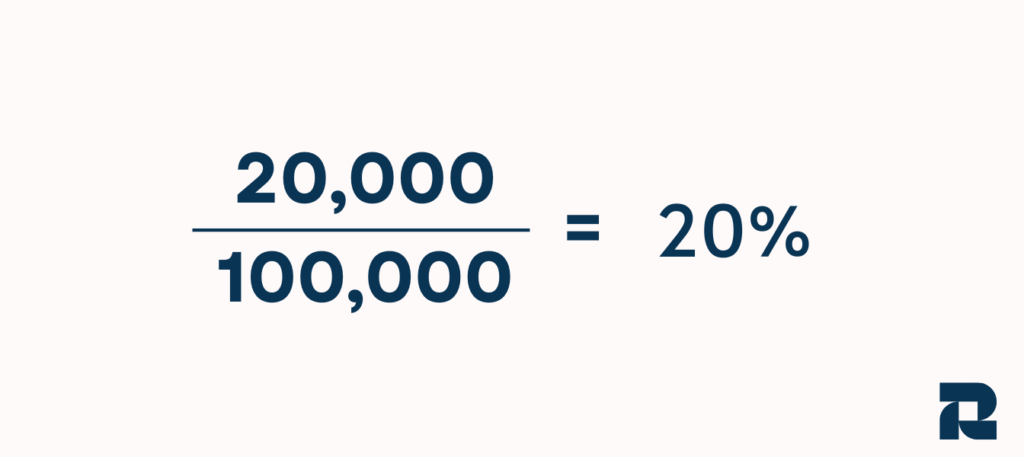

Imagine this setup:

- $20,000 after-tax contribution to traditional IRA

- $80,000 pre-tax rollover from old 401(k)

- You convert the $20,000 to Roth

Here’s what happens under the roth conversion pro rata rule IRS rules:

Only 20% of the conversion is tax-free. You pay income tax on 80% — or $16,000 — despite thinking your after-tax contribution would convert cleanly.

This is the exact logic the IRS uses, and it’s the same logic that applies when doing a mega backdoor roth pro rata conversion — unless you isolate the after-tax contributions within the 401(k).

Why the IRS Doesn’t Care Where the Money Came From

The IRS doesn’t care that your $20,000 was clean, after-tax money. Under the roth conversion pro rata rule IRS enforcement, it looks at your entire IRA balance across all accounts, not just the one you’re converting.

That’s why the safest way to avoid the mega backdoor roth pro rata problem is to:

- Keep after-tax funds inside a 401(k)

- Use in-plan Roth conversion options

- Roll pre-tax IRAs into your current employer’s 401(k)

Once you remove pre-tax IRA balances from the IRS equation, the mega backdoor roth pro rata tax exposure disappears.

For more technical breakdowns, visit our mega backdoor roth solo 401k guide — which is built specifically for high-income earners trying to avoid IRS aggregation rules.

Mega Backdoor Roth Withdrawal Rules

How Withdrawal Rules Work After a Mega Backdoor Roth Conversion

Once you’ve completed your mega backdoor roth conversion, understanding the withdrawal rules is crucial. The IRS doesn’t forget — and neither should you. Even if you successfully avoided the mega backdoor roth pro rata trap during conversion, messing up withdrawals could still trigger penalties and taxes.

The key rule is this: Roth IRA withdrawals are only tax-free if they’re qualified. That means:

- You must be at least 59½

- And the Roth account must be open for 5 years

If you withdraw earnings before meeting both of those criteria, you could owe income tax and a 10% penalty — even if the original mega backdoor roth conversion was done correctly.

What About the Converted Amount?

The amount you contributed and converted via mega backdoor roth can generally be withdrawn at any time tax- and penalty-free — because you already paid taxes (or verified it was after-tax). However, earnings on those contributions are still subject to the 5-year and age rules.

This is where the mega backdoor roth pro rata rule rears its head again. If you didn’t structure the conversion correctly, and a portion was taxed as pre-tax, then part of your basis in the Roth might be misunderstood — creating audit risk and possible taxation on early withdrawals.

That’s why at Retirin, we built a full breakdown on mega backdoor roth withdrawal rules — it helps you track contribution sources, timing, and future strategy.

Don’t Forget the Five-Year Clock Resets for Each Conversion

Every Roth conversion, including those through the mega backdoor roth strategy, triggers its own 5-year clock for penalty-free withdrawals — even if you’re over 59½. This rule exists separately from the standard Roth IRA 5-year rule for qualified distributions.

That means if you make annual mega backdoor roth conversions, you could have multiple 5-year clocks running — one for each year. And if you’re not careful, you could pull from earnings before one of those clocks matures and end up paying tax or penalties.

The best way to avoid these risks? Keep your records clean. Track each mega backdoor roth conversion. Confirm that the mega backdoor roth pro rata issue didn’t taint the transaction. And don’t touch the earnings until the withdrawal is fully qualified.

Mega Backdoor Roth Pro Rata Example

Real-Life Mega Backdoor Roth Pro Rata Scenario

Let’s look at a practical mega backdoor roth pro rata example — because the theory is one thing, but the math shows how easy it is to get burned.

Here’s the setup:

- Lisa, age 45, earns $200,000 per year

- Her 401(k) plan allows after-tax contributions and in-plan Roth conversions

- She also has a $100,000 traditional IRA from a previous employer

- She contributes $30,000 after-tax to her 401(k) and rolls it to a Roth IRA

Lisa assumes the mega backdoor roth strategy is tax-free — after all, it’s after-tax money. But because she didn’t clear out her pre-tax IRA, the IRS applies the mega backdoor roth pro rata rule.

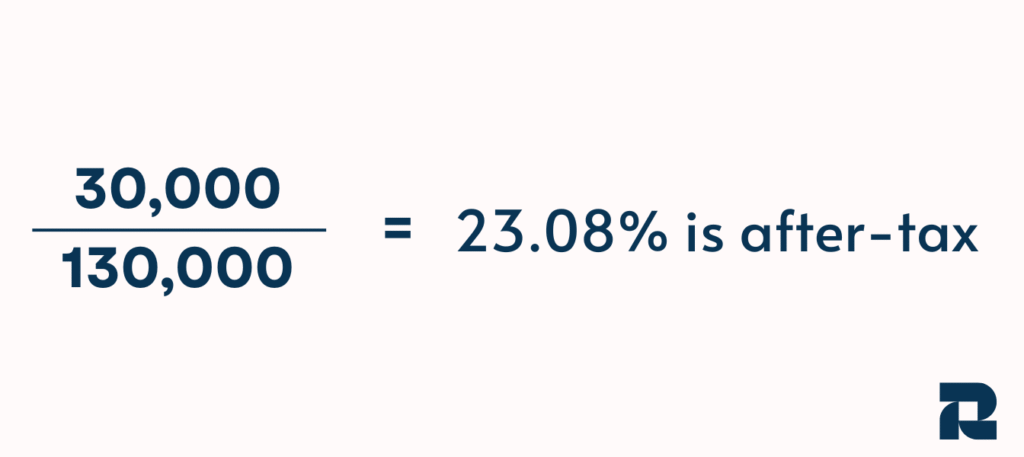

Here’s what the IRS sees:

| Type | Amount |

|---|---|

| Traditional IRA (pre-tax) | $100,000 |

| After-tax 401(k) | $30,000 |

| Total considered assets | $130,000 |

Now apply the pro rata ratio:

This means:

- Only $6,923 of her Roth conversion is tax-free

- $23,077 is taxable as ordinary income

Lisa thought she was executing a tax-efficient move. But because she ignored the mega backdoor roth pro rata rule, she triggered $23,077 of unexpected taxable income.

How Lisa Could Have Avoided It

To avoid this, Lisa should have:

- Rolled the $100,000 IRA into her 401(k) (if the plan allowed it), removing it from the IRA pool

- Used an in-plan Roth conversion of the after-tax amount before any IRA involvement

- Ensured no pre-tax IRA balances existed during the conversion year

By isolating the after-tax funds, she could have converted the full $30,000 tax-free with zero mega backdoor roth pro rata calculation.

This mega backdoor roth pro rata example is not hypothetical. I’ve worked with dozens of clients who ran into this exact situation. They were doing everything right — but in the wrong order.

The order of operations is what determines whether the mega backdoor roth works or fails.

Mega Backdoor Roth Pro Rata Fidelity

How Fidelity Handles Mega Backdoor Roth Pro Rata Rules

If you’re using Fidelity for your 401(k), you’ve probably come across their support for after-tax contributions and Roth in-plan conversions. Fidelity is one of the most mega backdoor roth-friendly platforms out there — but that doesn’t mean you’re safe from the mega backdoor roth pro rata rule.

In fact, many Fidelity participants mistakenly assume that just because the tools are there, the tax logic is handled for them. It’s not. You still need to take deliberate steps to avoid mega backdoor roth pro rata exposure.

Fidelity’s Two Paths — Only One Avoids Pro Rata Risk

Fidelity typically gives you two ways to execute your mega backdoor strategy:

- In-Plan Roth Conversion — This is done inside the 401(k) and does not trigger the mega backdoor roth pro rata rule, because it avoids the IRA system altogether.

- Distribution to Roth IRA — This sends the after-tax money to a Roth IRA and can trigger the mega backdoor roth pro rata rule if you have any pre-tax IRA balances.

Most investors default to the rollover route — because it’s easy. But unless they’ve cleared out all traditional IRA balances first, this will trigger the IRS aggregation formula. Fidelity processes the transaction, but the IRS still sees your entire IRA landscape — and applies the pro rata calculation.

Why In-Plan Conversion Is the Better Option at Fidelity

If you use Fidelity NetBenefits, the safest play is to:

- Contribute after-tax dollars to your 401(k)

- Convert those dollars to Roth inside the plan as soon as possible

This avoids the mega backdoor roth pro rata tax entirely because it never involves IRA assets. Everything stays within the 401(k) framework, which is not subject to IRS aggregation rules under Section 408(d)(2).

Fidelity Support and Documentation May Not Warn You

Fidelity’s platform is powerful — but it doesn’t warn you about pro rata traps. Many of their rollover interfaces are automated and don’t include disclaimers about your existing IRA balances. That’s why it’s essential to understand that Fidelity executes what you ask, but doesn’t protect you from triggering the mega backdoor roth pro rata calculation.

Before executing anything on Fidelity, check your traditional IRA balances. If they exist, use the in-plan option. If your plan doesn’t allow in-plan Roth conversion, consider rolling IRA balances into the 401(k) before any Roth movement.

We cover a similar path in our breakdown of Amazon mega backdoor roth users, where Fidelity is the plan custodian — and the same risks apply.

FAQs

Is Mega Backdoor Roth Subject to Pro-Rata?

Yes — if you convert after-tax 401(k) contributions to a Roth IRA and hold any pre-tax balances in traditional IRAs, the mega backdoor roth pro rata rule applies. The IRS will treat the conversion as a mix of pre- and post-tax funds unless you’ve removed all pre-tax IRA balances first. However, if you use an in-plan Roth conversion, the pro rata rule does not apply.

What Is the Pro-Rata Rule for Backdoor Roth Conversions?

The pro-rata rule is an IRS formula that calculates how much of your Roth conversion is taxable when you hold both pre-tax and after-tax IRA funds. It applies whether you’re doing a standard backdoor Roth or a mega backdoor roth unless you convert inside a 401(k).

What Are the Pitfalls of Mega Backdoor Roth?

The most common pitfall is triggering the mega backdoor roth pro rata tax unexpectedly. Others include:

Ineligible plan (not all 401(k)s allow after-tax contributions or in-plan Roth conversions)

Waiting too long to convert, allowing earnings to accumulate

Failing to roll over pre-tax IRA funds before conversion

Each of these can result in a larger tax bill or an invalid strategy.

Is Mega Backdoor Roth Better Than Backdoor Roth?

Yes, if your plan supports it. The mega backdoor Roth allows you to convert up to $69,000 (2024 limit) — far more than the $6,500 limit on a traditional backdoor Roth. But with more money comes more complexity — and a bigger risk if the mega backdoor roth pro rata rule is triggered.

Conclusion

I’ve seen the mega backdoor roth pro rata rule derail too many good plans — just because someone didn’t know to ask the right question. The strategy works, but only when executed with precision. Avoiding the pro rata rule isn’t just a technical step — it’s the difference between a tax-free Roth and a painful IRS letter.

Whether you’re using Fidelity, Solo 401(k), or a corporate plan, always double-check your IRA landscape before making the move. Start with our full guide at mega backdoor roth full guide and avoid the traps before they cost you.

Got questions? Drop them below — I’ve made the mistakes so you don’t have to.

Pin your future with us—explore tips, tools, and inspiration on the Retirin Pinterest page.