Mega Roth backdoor IRA 2025 might sound complex—but if you’re a high earner looking to shield more money from future taxes, it could be one of the last big moves left.

I first came across it a few years ago, back when I was trying to figure out if I was doing enough for retirement. The usual advice—401(k), IRA, maybe a Roth—just didn’t cut it for someone maxing out their contributions.

That’s when I discovered the mega Roth backdoor IRA. And in 2025, with contribution limits higher than ever and income thresholds still in play, it’s more useful—and misunderstood—than ever.

Let’s make it simple. We’ll walk through how it works, what’s new this year, and how to use it to your advantage. And if you’re looking for step-by-step help, our complete Mega Backdoor Roth guide has you covered.

Key Takeaways

The mega Roth backdoor IRA 2025 lets high earners move after-tax 401(k) contributions into a Roth IRA or Roth 401(k) for tax-free growth. Still legal, still powerful, and still one of the smartest retirement moves you can make in 2025.

In this article, we’ll discuss:

What Is a Mega Roth Backdoor IRA 2025?

How it works and who it’s for

The mega Roth backdoor IRA 2025 isn’t a product you buy—it’s a strategy that lets you move after-tax 401(k) contributions into a Roth IRA (or Roth 401(k)) to grow tax-free.

It’s designed for people who:

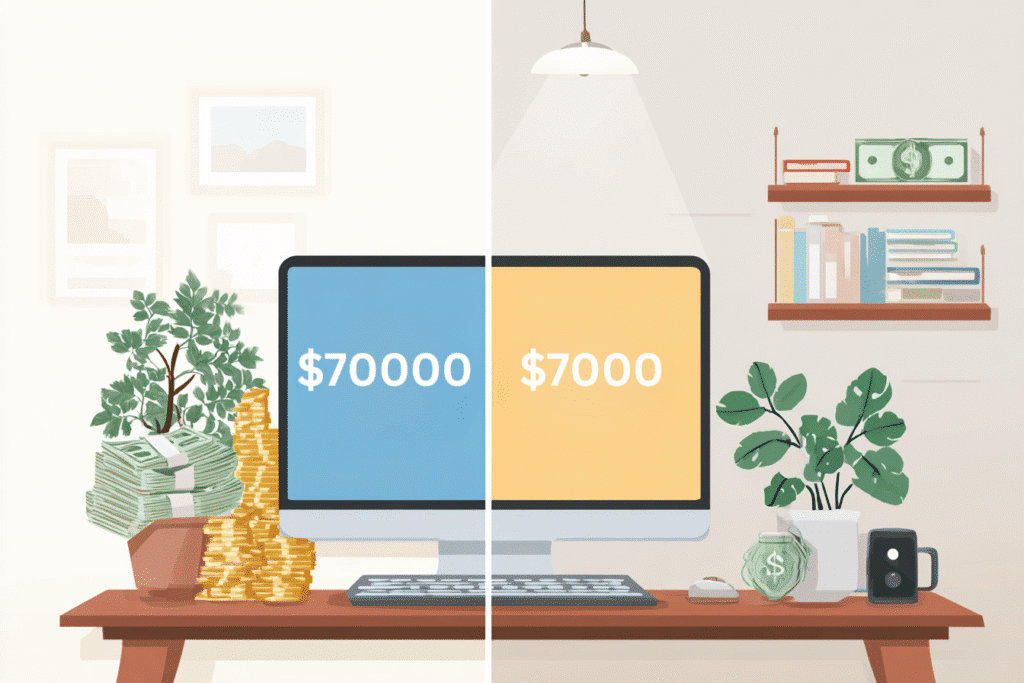

- Max out their traditional or Roth IRA (the $7,000 limit in 2025 doesn’t cut it)

- Earn too much to contribute directly to a Roth

- Want to supercharge their tax-free retirement savings

Here’s the basic flow:

- Contribute after-tax dollars to your 401(k), above the standard $23,000 limit.

- Your plan must allow in-service rollovers or Roth conversions.

- You move that after-tax money into a Roth IRA or Roth 401(k).

- It grows tax-free, and you’ve legally bypassed the Roth income limit.

Let me put it in real-life terms.

In 2020, I was contributing the regular $19,500 to my 401(k), and that was it. But one HR email (buried under PTO reminders) mentioned an “after-tax contribution option.” I clicked it out of curiosity. A few spreadsheets and a chat with my CPA later, I realized I could put in $30,000+ more—and shift it into a Roth. Legally.

The trick? My plan allowed in-plan Roth conversions, which is key. Not all do. (If yours doesn’t, check our Solo 401(k) Mega Roth guide.)

The real appeal in 2025? Tax-free compounding, and no RMDs in the future. That’s hard to beat.

Mega Backdoor Roth Limit 2025

How much can you contribute in 2025?

The mega Roth backdoor IRA 2025 is built on one key number: the total 401(k) contribution limit, which in 2025 is $70,000 if you’re 50 or older (thanks to the $7,500 catch-up). For everyone else, it’s $66,000.

Here’s how the math works:

| Contribution Type | Under 50 | Age 50+ |

|---|---|---|

| Employee Deferral | $23,000 | $23,000 |

| Employer Match/Profit Share | Varies | Varies |

| After-Tax Contribution (what fuels the mega backdoor Roth) | Up to remaining space after employer match and deferral |

So if you defer $23,000, and your employer adds $10,000 in match, you can put in up to $33,000 in after-tax dollars—and that’s the part you convert to Roth.

That’s the heart of the mega backdoor Roth IRA 2025: contributing beyond the traditional limits, then shifting it into a Roth account, where it grows tax-free forever.

And yes—it’s still legal in 2025. Despite chatter about Congress possibly closing this “loophole,” the mega backdoor Roth is still in play, and there’s no current legislation eliminating it.

For yearly updates on contribution ceilings, check our limit tracker page.

Quick tip: Your employer’s 401(k) plan must support after-tax contributions and in-service rollovers. Not sure? Ask HR. Or read our Fidelity-specific walkthrough if you’re using their platform.

Mega Backdoor Roth Tax Implications

What taxes do you pay in 2025?

Taxes are the number one reason people hesitate with a mega Roth backdoor IRA 2025. And I get it—I nearly backed out the first year I tried it. But the truth? When done right, the tax hit can be minimal—or even zero.

Here’s how it breaks down:

- The after-tax contributions to your 401(k)? You’ve already paid income tax on those.

- When you roll that money into a Roth IRA or Roth 401(k), the conversion itself is not taxed—as long as you only move after-tax dollars.

- Any growth on that money, though—even a penny—will be taxed at ordinary income rates if converted.

So the key with the mega Roth backdoor IRA 2025 is speed. You want to convert as soon as possible—before any earnings pile up. That’s what I do: I schedule monthly conversions to stay ahead.

Some plans, like Fidelity’s, even allow automatic in-plan Roth conversions, so you don’t have to lift a finger.

Also: there’s no pro-rata rule when doing the conversion inside a 401(k), which is a big advantage over a traditional backdoor Roth. But if you’re moving it to a Roth IRA, make sure you understand the pro-rata implications—we’ve broken that down in our Roth pro-rata rule post.

Remember, once inside a Roth, your money:

- Grows tax-free

- Can be withdrawn tax-free (after meeting certain rules)

- Doesn’t require RMDs (Required Minimum Distributions)

And that’s the long-term win of the mega Roth backdoor IRA 2025—you pay a little now to potentially pay nothing later.

Mega Backdoor Roth Withdrawal Rules

If you’re using the mega Roth backdoor IRA 2025, understanding withdrawal rules is critical. A wrong move could cost you in penalties or unexpected taxes.

The core concept? Roth conversions come with their own clock.

The 5-Year Rule for Mega Backdoor Roth IRA 2025

Each time you convert funds using the mega Roth backdoor IRA 2025, a five-year waiting period starts on that specific conversion. That means a conversion done in 2025 can’t be withdrawn penalty-free until 2030—unless you’re already age 59½ or older.

Here’s how the withdrawal breaks down:

- Converted contributions: You can withdraw the principal at any time, tax- and penalty-free.

- Earnings: If withdrawn before five years pass—or before age 59½—you may owe income tax and a 10% penalty.

Unlike traditional Roth IRAs, which use a single five-year rule starting with your first contribution, each mega backdoor Roth conversion has its own 5-year clock. That’s why accurate recordkeeping is essential when executing a mega Roth backdoor IRA 2025 strategy year after year.

I keep a running spreadsheet. One column for year, one for amount converted, one for when it’s penalty-free. Simple, but crucial.

Why Roth IRAs Are Better for Withdrawals

Once your after-tax 401(k) funds are converted to a Roth IRA through a mega Roth backdoor IRA 2025, you eliminate required minimum distributions (RMDs) entirely. Unlike Roth 401(k)s, Roth IRAs don’t require you to withdraw money at any age.

That’s why many choose to roll their after-tax contributions into a Roth IRA, not a Roth 401(k). The flexibility in withdrawal is a major benefit of executing a mega Roth backdoor IRA 2025 correctly.

If you’re unsure about timing or tax consequences, we’ve outlined detailed timelines in our withdrawal rules guide.

Mega Backdoor Roth vs Backdoor Roth

In 2025, more people are asking whether they should use the backdoor Roth or go all in on the mega Roth backdoor IRA 2025. They sound similar—but they’re designed for very different situations.

Let’s break it down.

| Feature | Backdoor Roth IRA | Mega Roth Backdoor IRA 2025 |

|---|---|---|

| Contribution Limit | $7,000 ($8,000 with catch-up) | Up to $70,000 total 401(k) space |

| Income Limit Avoidance | Yes | Yes |

| Based On IRA or 401(k)? | Traditional IRA → Roth IRA | After-tax 401(k) → Roth IRA or Roth 401(k) |

| Employer Plan Required | No | Yes |

| Pro-Rata Rule Applies? | Yes | No (if in-plan conversion) |

| RMDs Apply? | No (Roth IRA) | No (if funds moved to Roth IRA) |

The backdoor Roth IRA is a great entry-level strategy if you’re over the income limit for Roth contributions and don’t have access to after-tax 401(k) contributions. But you’re capped at just $7,000 in 2025 ($8,000 if you’re over 50).

The mega Roth backdoor IRA 2025 takes things to an entirely different level. By using the after-tax portion of your 401(k), you can contribute tens of thousands more—potentially up to $47,000+ in extra Roth money each year.

That’s a game-changer. Especially if your plan allows in-service rollovers or in-plan Roth conversions.

Here’s what I did. Back when I first discovered the mega strategy, I was already doing backdoor Roth contributions. But once I realized my employer plan allowed after-tax 401(k) contributions, I shifted fast. The ability to add over six times more per year into a Roth account made the decision clear.

For a deeper comparison, see our full analysis at mega backdoor Roth vs backdoor Roth.

Fidelity Mega Backdoor Roth IRA 2025

If you’re setting up a mega Roth backdoor IRA 2025, one name comes up again and again: Fidelity.

Here’s why Fidelity is a top choice in 2025:

- Supports after-tax 401(k) contributions

Fidelity’s 401(k) plans are among the few that consistently allow employees to make after-tax contributions above the standard limit, making the mega Roth backdoor IRA 2025 possible. - Enables in-plan Roth conversions and rollovers

Fidelity makes it relatively simple to move after-tax dollars from your 401(k) into a Roth 401(k) or external Roth IRA. Some plans even allow automatic in-plan conversions, which reduces the chance of earnings accumulating (and triggering tax). - Clear reporting and transaction tools

Their online dashboard allows you to track after-tax balances, initiate rollovers, and manage conversions without getting lost in paperwork.

In my own experience, I used Fidelity to roll over $24,000 in after-tax contributions into my Roth IRA within two days—no calls, no letters, no confusion. If your employer’s 401(k) is run through Fidelity, you’re already set up for a smoother mega Roth backdoor IRA 2025 process.

Still, not all employer plans enable the key pieces. Always confirm:

- After-tax contribution capability

- In-service withdrawals or in-plan Roth conversions

For business owners using Fidelity for solo 401(k)s, don’t miss our guide: Solo 401(k) mega Roth strategy.

FAQs

What is the mega backdoor Roth limit for 2025?

The total 401(k) contribution limit for 2025 is $66,000, or $73,500 if you’re 50 or older (including the $7,500 catch-up). That includes your deferrals, employer contributions, and after-tax contributions.

The mega Roth backdoor IRA 2025 uses the after-tax portion of this total limit. So, for example, if you defer $23,000 and your employer contributes $10,000, you can contribute up to $33,000 more in after-tax dollars—then convert it to Roth.

We update the full breakdown yearly at mega backdoor Roth limit 2025.

Will the backdoor Roth be eliminated in 2025?

As of mid-2025, no legislation has passed eliminating either the backdoor Roth or the mega Roth backdoor IRA 2025. While Congress has floated proposals in the past, including during the Build Back Better era, nothing has stuck.

The strategy remains legal and widely used—especially by high earners and business owners. We’re tracking all updates closely at Retirin’s policy hub.

What is the mega backdoor Roth $70,000 in 2025?

The $70,000 figure refers to the total 401(k) contribution limit for those age 50+ in 2025. It combines:

$23,000 employee deferral

$7,500 catch-up contribution

Up to $39,500 in employer + after-tax contributions

When you max out that space and roll your after-tax dollars into a Roth account, you’re using the mega Roth backdoor IRA 2025 to its fullest.

What is the 5-year rule for mega backdoor Roth conversion?

Each Roth conversion under the mega Roth backdoor IRA 2025 starts a separate 5-year clock. You must wait five years before withdrawing the converted amount without penalty (unless you’re over 59½). Earnings on that amount also follow the five-year rule.

For example, if you convert $20,000 in 2025, you can’t touch that $20,000 penalty-free until 2030. That’s why good tracking is essential—especially if you convert yearly.

More details are in our withdrawal rules guide.

Conclusion

When I first heard about the mega Roth backdoor IRA 2025, it sounded like something only financial pros pulled off. But the truth? It’s one of the most powerful, legal tax-saving strategies still available for regular earners with good jobs and growing incomes.

If you’re already maxing out your 401(k), wondering what more you can do, this is it. The mega Roth backdoor IRA 2025 is still alive, still smart, and still incredibly valuable—if you use it correctly.

I’ve used it to put away tens of thousands more every year, and I’ve seen the difference it makes not just on paper, but in peace of mind. Tax-free growth. No RMDs. A legacy for my kids.

If you’ve made it this far, you already care about your future. Take the next step and check if your plan allows after-tax 401(k) contributions. Run the math. Talk to HR. Then start building your tax-free retirement engine now.

For more details, check out our mega backdoor Roth for business owners or deep-dive into mega Roth tax planning next.

Got questions or your own story with the mega strategy? Leave a comment or share this with a friend who needs it.

Pin your future with us—explore tips, tools, and inspiration on the Retirin Pinterest page.